MODULE 1: Understanding Debt – The Basics

Duration: 25 minutes

Learning Objectives:

•Define debt and explain how it works

•Understand interest rates and their long-term impact

•Identify different types of debt products

•Recognize the psychological aspects of borrowing

Content Outline:

1.1 What is Debt? (5 min)

•Definition: Money borrowed that must be repaid with interest

•The debt cycle: borrowing → spending → repayment

•Why debt exists in modern society

Debt exists in modern society because it solves a few basic problems that show up anytime people trade, build, and plan for the future:

-

It lets people buy big things before they’ve saved up. Homes, cars, education, equipment—most households and businesses can’t pay cash upfront, so debt spreads the cost over time.

-

It smooths out uneven income. Many people get paid biweekly, seasonally, or irregularly. Debt (credit cards, lines of credit) helps cover timing gaps—rent due now, paycheck later.

-

It helps businesses grow faster. A business can borrow to buy inventory, hire staff, or purchase machines todayand pay it back from future profits, instead of growing only as fast as cash allows.

-

It funds large public projects. Governments issue bonds to build roads, schools, water systems, and infrastructure now, then pay over time—because waiting to “save up” would stall society.

-

It’s a “price” for risk and time. Lenders take the risk you won’t repay and give up the chance to use their money elsewhere. Interest is the fee for (1) time and (2) risk.

-

It’s baked into modern banking. Banks don’t just store money—they lend it. Lending is how the financial system channels money into housing, business, and consumption, which drives economic activity.

-

It can be useful and profitable to sell. Debt products are a major industry. Marketing + convenience makes borrowing feel easy, which increases usage—even when it’s not in the borrower’s best interest.

•Real scenario: Alex borrows $1,000 at 15% APR – what does it really cost?

Quick Summary

| Term | Loan Amount | APR | Total Repaid | Interest Cost |

|---|---|---|---|---|

| 1 year lump sum | $1,000 | 15% | $1,150 | $150 |

| 12-month installments | $1,000 | 15% | $1,082.88 | $82.88 |

| Minimum credit card ($25/month) | $1,000 | 15% | $1,400+ | $400+ |

1.2 How Interest Works (8 min)

•Simple vs. compound interest explained

Simple interest

Interest is calculated only on the original amount borrowed (the principal).

Formula:

Interest = Principal × Rate × Time

Example: $1,000 at 15% for 1 year

Interest = 1000 × 0.15 × 1 = $150

Total = $1,150

If it’s 2 years (still simple):

Interest = 1000 × 0.15 × 2 = $300

Total = $1,300

Compound interest

Interest is calculated on the principal + any interest that’s already been added.

So interest starts earning interest. That’s the “snowball.”

Formula (basic):

Future Value = Principal × (1 + rate/n)^(n×time)

(n = how often it compounds: monthly, daily, etc.)

Example: $1,000 at 15% compounded monthly for 1 year

Monthly rate = 0.15/12 = 0.0125

Future Value = 1000 × (1.0125)^12 ≈ $1,160.75

Interest ≈ $160.75 (more than $150 because of compounding)

The key difference (in plain English)

-

Simple interest = “interest stays flat” (only on the starting amount)

-

Compound interest = “interest stacks” (you pay/earn interest on interest)

Real-life where you see each

-

Simple interest (often): some auto loans, some personal loans (though payment schedules can still feel “front-loaded”)

-

Compound interest (common): credit cards, many lines of credit, savings/investing accounts (compounding helps you when you’re the saver)

APR (Annual Percentage Rate) is the yearly “all-in” cost of borrowing money.

-

It includes the interest rate plus many lender charges like origination fees, some closing costs, and certain finance charges (what’s included depends on the product and rules).

-

It lets you compare loans more fairly: two loans can have the same interest rate but different APRs if one has higher fees.

Quick example:

If you borrow $1,000 at 15% APR, you’re paying about $150 per year in borrowing cost if the balance stayed the same all year. If you pay it down monthly, you’ll usually pay less total interest.

Key point:

Interest rate = cost of the money.

APR = cost of the money + many fees, expressed as a yearly rate.

•The “rule of 72” – how quickly debt doubles

Rule of 72: A quick way to estimate how long it takes a debt (or investment) to double.

Formula:

Years to double ≈ 72 ÷ interest rate (as a %)

Examples:

-

15% APR: 72 ÷ 15 = 4.8 years (about 4 years 10 months)

-

24% APR (common credit card): 72 ÷ 24 = 3 years

-

6% APR: 72 ÷ 6 = 12 years

Big warning: debt “doubling” happens fastest when the balance isn’t being paid down much (like minimum payments), because interest keeps stacking.

•Interactive calculator: See how $5,000 grows at different interest rates

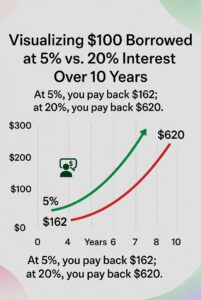

•Video example: Visualizing $100 borrowed at 5% vs. 20% over 10 years

1.3 Types of Debt Products (7 min)

•Credit cards

•Student loans

•Auto loans

•Personal loans

•Buy Now, Pay Later services

•Payday loans (warning signs)

•Peer-to-peer lending

1.4 The Psychology of Debt (5 min)

Borrowing feels easy because it gives you instant relief. Repayment feels hard because it creates ongoing friction.

-

Instant reward vs delayed pain. Borrowing solves the problem today (rent, car repair, “I need it now”). Your brain likes immediate wins. Repayment is slow, boring, and delayed—so it feels heavier.

-

You feel the benefit once, but you feel the cost many times. The purchase/relief is one moment. The payments show up every month (sometimes for years).

-

Minimum payments make it feel affordable while keeping you stuck. Many debts are designed so the required payment is small, but the interest keeps ticking, so progress feels painfully slow.

-

Payments come out of “future income,” which is already spoken for. Bills, groceries, gas, kids, emergencies—repayment competes with real life. Borrowing didn’t have to “compete,” it just happened.

-

Interest turns time into a penalty. The longer you take, the more it costs. So repayment isn’t just paying back what you borrowed—it’s paying rent on the money.

-

Lifestyle creep and habit. Once you adjust to having the thing (or the relief), going backward—cutting spending to repay—feels like loss.

-

Emotion + shame adds weight. Debt can trigger stress, avoidance, and “I’ll deal with it later,” which makes repayment harder even when the math is doable.

•The “future self” problem

The “future self” problem is when your brain treats Future You like a different person… so Present You makes choices that Future You has to clean up.

How it shows up with money/debt:

-

Borrowing feels like “free money” today because the pain is pushed onto Future You.

-

Repayment feels unfair later because Future You experiences it as a real loss of cashflow (rent, bills, life), not as “that thing you bought back then.”

-

You underestimate how busy/expensive life will be later, so you overcommit now (“I’ll easily pay it off next month”).

-

Small payments don’t feel dangerous in the moment, but they stack up and turn into a fixed monthly burden.

A simple way to beat it (practical, not fluffy):

-

Make Future You real: name the payoff goal (“Debt-free by Sept 2026”), put the number somewhere visible, and set autopay the day after payday.

-

Use “one-time pain” moves: cut the card, move the balance to a lower APR if possible, or pick a fixed payment that actually shrinks principal.

-

Add a 24-hour rule for new debt: if it isn’t an emergency, wait 24 hours before borrowing.

•Social pressure and “keeping up” spending

Social pressure spending is when you buy things to avoid feeling left out, judged, or “behind”—even if your budget can’t support it. It’s “keeping up,” but it quietly turns into debt and stress.

How it hooks you

-

Status signaling: clothes, car, vacations, gadgets = “I’m doing good.”

-

FOMO: saying yes to trips, dinners, events so you don’t miss the moment.

-

Group norms: if your circle spends $150 a night out, it feels “normal.”

-

Comparison loops: social media highlights (wins only) make regular life feel like failure.

Why it’s financially brutal

-

It’s often recurring (monthly lifestyle), not one-time.

-

It usually hits high-interest debt (credit cards), so you pay extra just to look “caught up.”

-

It steals from your future goals (emergency fund, down payment, freedom).

Simple ways to beat it without becoming a hermit

-

Pick your “yes budget”: “I spend $150/week on fun—no guilt, no debt.”

-

Use scripts: “I’m on a savings sprint—coffee instead of dinner?” / “I’m tapped this week, next time.”

-

Anchor to your real flex: cash cushion, paid-off car, investments. That’s the quiet win.

-

Change the default: host potlucks, hikes, game nights, free community events.

•Reflection: What’s your relationship with money?

Interactive Elements:

•Quiz: 7 questions on interest calculations and debt types

•Calculator Tool: Interest rate comparison tool

•Reflection Prompt: “What debts do people in your life have? What have you observed?”

Downloadable Resources:

•Debt Types Comparison Chart (PDF)

•Interest Rate Calculator Template (Excel)

•Debt Terminology Glossary